Services

Personal Tax

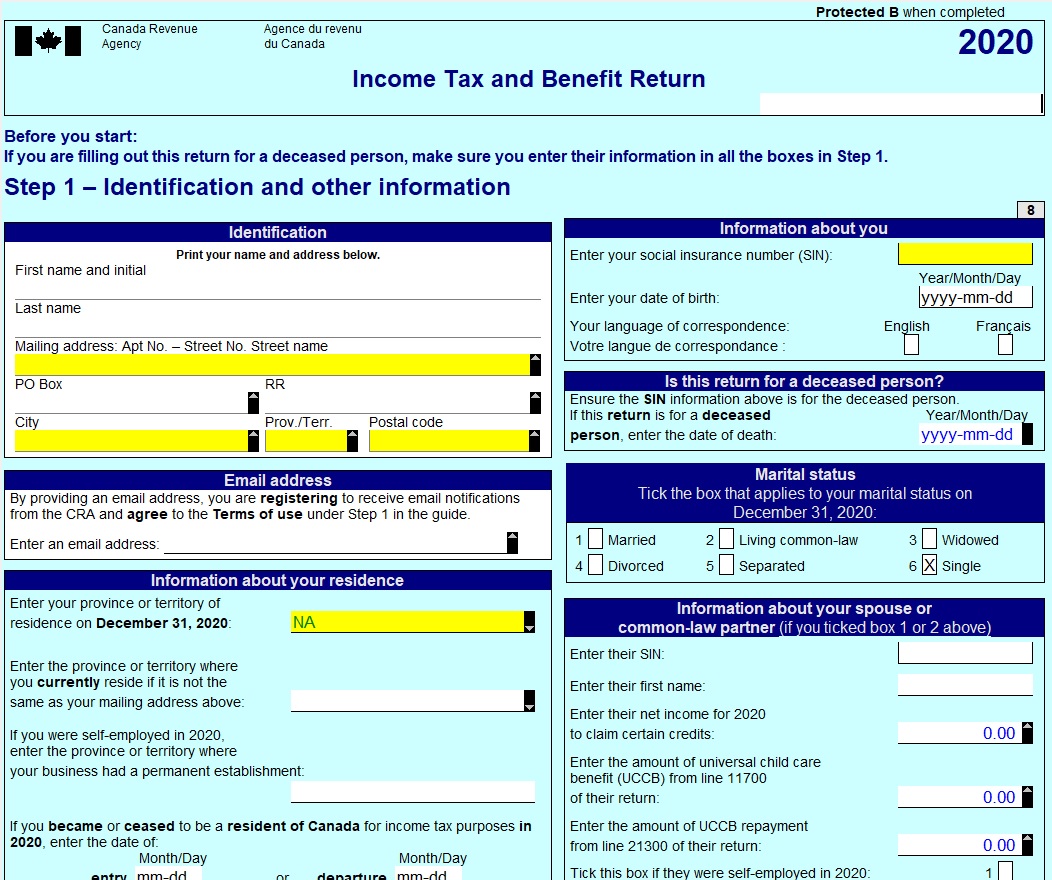

Tax Services for Individual

Individual Tax & Benefit returns can be full prepared online. Take a look below in our Tax Preparation Workflow and start submitting your information to us.

Our Tax Preparation Workflow

Fill up the Information Form

Fill up our information form. Give us all information that we need to best serve you.

Authorize

To allow us working with your Tax and Benefit return, the CRA request a Represent a Client Form filled and signed by the Tax Payer.

Attaching

To better help you we will need all support documents you may have with you. You can send us copy of documents using PDF or JPG.

Analyze

T&A Team will check all received information, access the CRA to find out extra information, and contact you if extra information is needed.

Prepare

T&A Team will prepare your Tax and Benefit Return

Share the Result

When the work is done we will contact you and share the Tax and Benefit Return result to you before sending it to the CRA.

Payment

After all done you can choose the best way to pay for our service and complete the payment.

File

T&A Team will send your Tax and Benefit Return to the CRA

Save

After sending the file to CRA, we will pack all your files and send it to you.